The Eighteenth Amendment to the US Constitution, establishing Prohibition, brought about drastic changes in the role of the federal government and its interactions with Americans, and fundamentally changed the way we live. It also set off a cascade of unintended and unforeseen consequences and changes impacting a bewildering variety of subjects. The rise of organized crime, the concept of home dinner parties, modern American tourism habits, radical changes in speedboat design, and the deep engagement of women in politics – all the preceding, and more, can be traced back to Prohibition. It ended in failure, but it changed America forever. How did it come about? Following are forty things about the road to that fascinating American experiment.

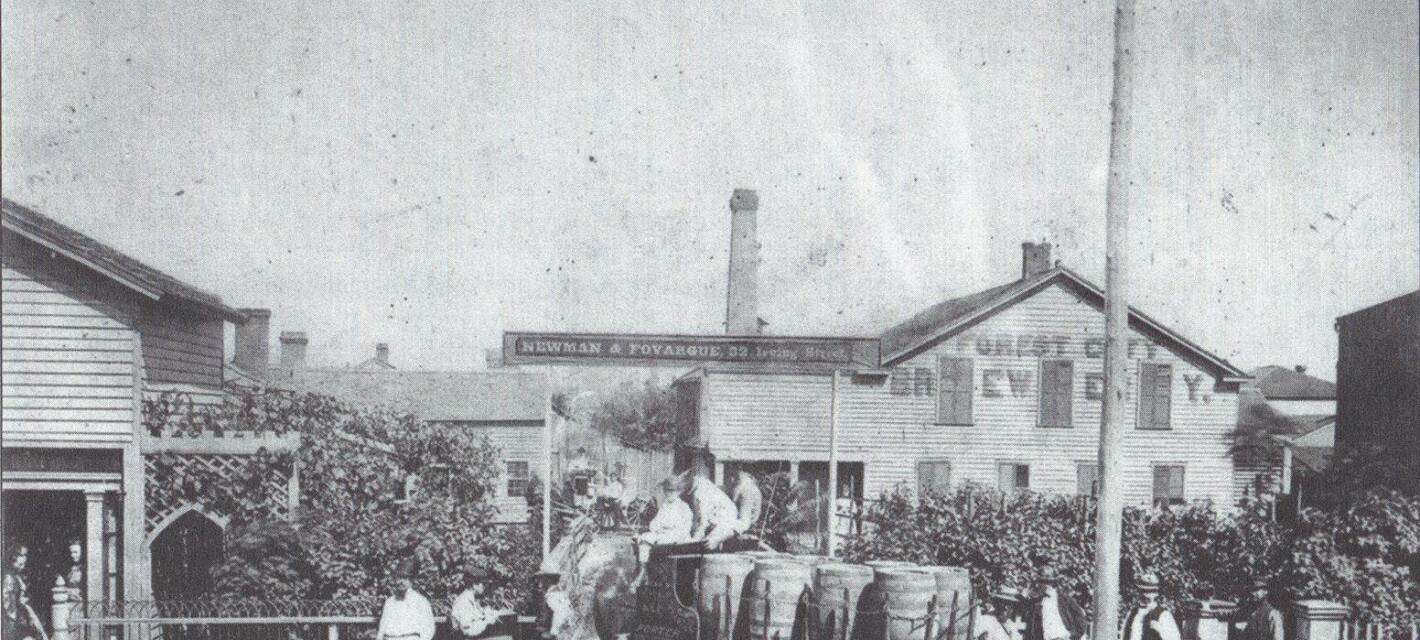

40. America Had a Serious Drinking Problem

As the history and ultimate fate of Prohibition demonstrate, it was a flawed and misguided attempt to address a problem. However, Prohibition did not occur in a vacuum, and the problem it had sought to address was all too real, and quite serious.

In a nutshell, America was, collectively speaking, a lush. A straight-up alcoholic country, in which booze was consumed and abused at levels far greater than any we are used to today.